1814 W. Tacoma Street

Broken Arrow, Oklahoma 74012

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 4, 2006

Notice is hereby given that the Annual Meeting of Shareholders of XETA Technologies, Inc. will be held at the Renaissance Tulsa Hotel and Convention Center located at 6808 South 107th East Avenue, Tulsa, Oklahoma, on April 12, 20054, 2006 at 6:30 p.m., local time, for the following purposes:

1. To elect five (5) members to the Company’s Board of Directors to serve until the next Annual Meeting of Shareholders and until their successors have been elected and qualified; 2. To ratify the selection of Tullius Taylor Sartain & Sartain LLP as independent certified public accountants for the Company for the 2006 fiscal year; and 3. To transact such other business as may properly come before the meeting or any adjournment or adjournments thereof.

|

|

|

|

| |

|

|

The Board of Directors has fixed the close of business on February 25, 2005,21, 2006, as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting or any adjournment or adjournments thereof. Only shareholders of record at such time will be so entitled to vote. The Company’s Proxy Statementproxy statement is attached. The Proxy Statementproxy statement and form of proxy will first be sent to shareholders on or about March 11, 2005. 7, 2006.

It is important that your stock be represented at the Annual Meeting regardless of the number of shares you hold. If you do not expect to attend the meeting in person, please sign, date, and return the enclosed proxy or voting instructions in the accompanying envelope or you may vote via the internet in accordance with the instructions on your proxy card.envelope. The giving of this proxy does not affect your right to vote in person in the event you attend the meeting.

| By Order of the Board of Directors | |

|

| |

| /s/ | |

Robert B. Wagner | ||

February 18, 2005

|

| |

|

| |

| ||

Robert B. Wagner | ||

Corporate Secretary | ||

February 14, 2006

PROXY STATEMENT

Annual Meeting of Shareholders

To be Held April 4, 2006

SOLICITATION OF PROXIES

This Proxy Statement is being furnished to shareholders of XETA Technologies, Inc. (the “Company”) by its Board of Directors to solicit proxies for use at the Annual Meeting of Shareholders (the “Annual Meeting”) to. The Annual Meeting will be held on April 12, 2005,4, 2006, at the Renaissance Tulsa Hotel and Convention Center located at 6808 South 107th East Avenue, Tulsa, Oklahoma, at 6:30 p.m., local time, or at such other time and place to which the Annual Meeting may be adjourned.

time. The purpose of the Annual Meeting isis: (i) to elect five (5) members to the Company’s Board of Directors (the “Board”) to serve for the ensuing year and until their successors are elected; (ii) to ratify the selection of Grant ThorntonTullius Taylor Sartain & Sartain LLP as the Company’s independent certified public accountants for the fiscal year ending October 31, 2005;2006; and (iii) at the discretion of the proxy holders, to transact any other business that may properly come before the Annual Meeting or any adjournment thereof.

Your

This Proxy Statement and the accompanying proxy card will first be mailed to shareholders on or about March 7, 2006. Only shareholders of record at the close of business on February 21, 2006 (the record date) are entitled to vote is important. Shares may be voted at the Annual Meeting only if you are presentand any adjournment thereof.

Voting

You may vote in person at the Annual Meeting or represented by proxy. Stockholders of record can vote their shares either by promptly completing and returning the enclosed Proxy card in the envelope provided, or by following the internet voting procedures and instructions described on the Proxy card. If you hold your shares in your own name on the name ofrecord date and not through a broker, bank or in some other “street name” capacity, you may vote by proxy by completing the enclosed proxy card and then signing, dating and returning it in the envelope provided. If you hold your shares in “street name” (that is, through a broker, bank or other agent) as of the record date, the organization holding your account is considered to be the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner of the shares, you have the right to direct your broker, bank or other agent on how to vote the shares in your account. To do so, please follow the voting instructions on the form you receive from them. Any shareholder giving a Proxy has the powerIf your shares are held in “street name” and you wish to revoke itvote in person at any time before it is exercised by executing a subsequently dated proxy, submitting a notice of revocation to the Company, or attending the Annual Meeting, and votingyou must obtain from your broker, bank or other agent a legal proxy issued in person. your name giving you the right to vote the shares.

Proxies properly executed and received by the Company will be voted in accordance with the specifications marked on the Proxyproxy card. Proxies containing no specifications will be voted in favor ofFOR the proposals described in this Proxy Statement. Votes will be tabulated by UMB Bank, n.a.

It

Revocability of Proxies

Any shareholder giving a proxy has the power to revoke it at any time before it is expected that this Proxy Statementacted upon. Shareholders may revoke their proxy by submitting a notice of revocation to the Company, submitting another proxy with a later date, or by voting in person at the Annual Meeting. If you hold your shares in street name, you must contact your broker, bank or other agent regarding how to revoke your proxy and change your vote.

Voting Rights

Shareholders are entitled to one vote per share of Common Stock registered in their name on the accompanying Proxy card will first be mailedrecord date. As of January 17, 2006, there were 10,209,573 shares of Common Stock of the Company outstanding, the only voting stock of the Company.

A majority of the shares entitled to shareholdersvote, present in person or represented by proxy, is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes are counted as shares present in determining whether the quorum requirement is satisfied. Abstentions are also counted in the total number of votes cast with respect to a proposal and thus have the same effect as a vote against the matter. Broker non-votes are not counted as votes cast in the tabulation of votes on or about March 11, 2005. any matter brought before the Meeting. The affirmative vote of a majority of the shares of the Company’s Common Stock having voting power at the Annual Meeting is required for the election of directors.

Cost of Solicitation

The cost of soliciting proxies will be borne by the Company. The Company will reimburse brokerage firms, banks and other nominees, custodians and fiduciaries for their reasonable expenses incurred in sending proxy materials to beneficial owners of shares and obtaining their instructions. The Company has retained UMB Bank, n.a. to assist in the distribution of the Proxy cards and Proxy Statements. Votes will be tabulated by UMB Bank, n.a.

VOTING SECURITIESproxy materials.

Only shareholders of record at the close of business on February 25, 2005 (the record date) are entitled to vote at the Annual Meeting and any adjournment thereof. As of January 31, 2005, there were 10,045,487 shares of Common Stock of the Company outstanding (excluding 1,018,788 shares held in treasury). Shareholders are entitled to one vote per share of Common Stock registered in their name on the record date. A majority of the shares entitled to vote, present in person or represented by proxy, is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes are counted as shares present in determining whether the quorum requirement is satisfied but are not counted as votes cast in the tabulation of votes on any matter brought before the Meeting. The affirmative vote of a majority of the shares of the Company’s Common Stock represented at the Annual Meeting is required for the election of directors.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information known to the Company as of January 31, 2005 regarding beneficial ownership of the Company’s Common Stock, par value $.001 per share, by (a) each person known by the Company to own more than five percent (5%) of the Company’s Common Stock, (b) each director and nominee for election as a director of the Company, (c) each executive officer named in the Summary Compensation Table, and (d) all directors and executive officers of the Company as a group.

Name and Address |

| Amount and Nature |

| Percent of |

| ||

|

|

| |||||

Directors and Executive Officers (b), (c) and (d) above |

|

|

|

|

|

|

|

Jack R. Ingram |

|

| 1,290,579 | (3) |

| 12.80 | % |

Ronald L. Siegenthaler |

|

| 1,117,003 | (4) |

| 11.11 | % |

Larry N. Patterson |

|

| 154,827 | (5) |

| 1.52 | % |

Robert B. Wagner |

|

| 126,046 | (6) |

| 1.24 | % |

Ron B. Barber |

|

| 118,472 |

|

| 1.18 | % |

Robert D. Hisrich |

|

| 56,550 |

|

|

| * |

Donald T. Duke |

|

| 44,500 |

|

|

| * |

All officers and directors as a group |

|

| 2,907,977 |

|

| 28.08 | % |

Others Known to Own 5% |

|

|

|

|

|

|

|

FMR Corp. |

|

| 974,969 | (7) |

| 9.71 | % |

Jon A. Wiese |

|

| 580,000 | (8) |

| 5.46 | % |

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

|

|

PROPOSAL 1

ELECTION OF DIRECTORS

Information Concerning the Nominees

The Company’s certificate of incorporation and bylaws provide that the Board of Directors shall consist of such number of directors as is fixed from time to time by resolution of the Board of Directors. The authorized number of directors is currently set at five members. Members of the Board are elected for one-year terms.

The nominees for election to the Board of Directors are set forth below. All of the nominees are currently directors of the Company. Three of the nominees nominees—Mr. Duke, Dr. Hisrich and Mr. Siegenthaler—are independent in accordance with Nasdaq rules. All of the nominees have indicated a willingness to serve if elected. If any nominee should become unavailable for election for any presently unforeseen reason, the persons designated as proxies will have full discretion to cast votes for another person designated by the Board. All of the nominees are currently directors of the Company. None of the nominees havehas any family relationship to any other nominee, and there are no arrangements or understandings between any of the nominees and any other person(s) pursuant to which any of the nominees are to be elected as directors.

Name | Positions With Company | Director Since | ||

|

|

|

| |

Ron B. Barber |

| Director |

| March 1987 |

|

|

|

|

|

Donald T. Duke |

| Director |

| March 1991 |

|

|

|

|

|

Dr. Robert D. Hisrich |

| Director |

| March 1987 |

|

|

|

|

|

Jack R. Ingram |

| Chairman of the Board and |

| March 1989 |

|

|

|

|

|

Ronald L. Siegenthaler |

| Director |

| September 1981 |

3

Mr. Barber, age 50,51, has been a director of the Company since March 1987. He has been engaged in the private practice of law since October 1980 and is a shareholder in the law firm of Barber & Bartz, a Professional Corporation, in Tulsa, Oklahoma, which serves as counsel to the Company. Mr. Barber is also a Certified Public Accountant licensed in Oklahoma.

Mr. Duke, age 55,56, has been a director of the Company since March 1991. From 1980 until August, 2002, he was in senior management in the oil and gas industry, including time as President and Chief Operating Officer of Hadson Petroleum (USA), Inc., a domestic oil and gas subsidiary of Hadson Corporation, where he was responsible for all phases of exploration and production, land, accounting, operations, product marketing and budgeting and planning. Since then, through Duke Resources Co. L.L.C., he has been a consultant to the oil and gas industry.

Dr. Hisrich, age 60,61, has been a director of the Company since March 1987. He occupiescurrently holds the Garvin Professor of Global Entrepreneurship and is Director of the Global Entrepreneurship Center at Thunderbird, the Garvin School of International Management in Glendale, Arizona. Previously he occupied the A. Malachi Mixon III

2

Chair in Entrepreneurial Studies and iswas Professor of Marketing and Policy Studies at the Weatherhead School of Management at Case Western Reserve University in Cleveland, Ohio. Prior to assuming such positions, he occupied the Boviard Chair of Entrepreneurial Studies and Private Enterprise and was Professor of Marketing at the College of Business Administration for the University of Tulsa. He is also a marketing and management consultant. He is a member of the Board of Directors of Jameson Inn, Inc., Noteworthy Medical Systems, Inc., and NeoMed Technologies, and is a member of the Editorial Boards of the Journal of Venturing and the Journal of Small Business Management.

Mr. Ingram, age 61,62, has been the Company’s Chief Executive Officer since July 1990. He also served as the Company’s President from July 1990 until August 1999 and re-assumed that position infrom June 2001.2001 until July 2005. He has been a director of the Company since March 1989. Mr. Ingram’s business experience prior to joining the Company was concentrated in the oil and gas industry.

Mr. Siegenthaler, age 61,62, has been a director of the Company since its incorporation. He also served as the Company’s Executive Vice President from July 1990 until March 1999. Since 1974, through SEDCO Investments, a partnership in which Mr. Siegenthaler is a partner, and as an individual, Mr. Siegenthaler has been involved as partner, shareholder, officer, director, or sole proprietor of a number of business entities with significant involvement in fabrication and marketing of steel, steel products and other raw material, real estate, oil and gas, and telecommunications.

RECOMMENDATION

Recommendation

The Board of Directors unanimously recommends that shareholders vote “For”FOR the election of all of the nominees listed above as directors of the Company.

BOARD OF DIRECTORS AND COMMITTEES

Board Meetings

The Board of Directors of the Company held three meetings during the fiscal year ended October 31, 2004.2005. None of the directors attended fewer than 75% of the combined total of all Board meetings and meetings of Committees of which they were a member during fiscal 2004.2005, except for Dr. Hisrich who attended 70% of such meetings. Dr. Hisrich attended all of the Board meetings and four of the seven Committee meetings on which he served. All other action taken by the Board of Directors was consented to in writing by a Memorandum of Action in lieu of a meeting, to which all incumbent directors subscribed. Directors meet their responsibilities not only by attending Board and committee meetings but also through communication with members of management on matters affecting the Company.

The Company encourages its three local directors to attend the annual meeting of shareholders. All of these members were present at the Company’s April 6, 200412, 2005 Annual Meeting. In addition, Mr. Duke traveled from Oklahoma City to attend the Annual Meeting.

Committees

The Board of Directors has an Audit Committee, Compensation Committee, and Nominating Committee.

4

Audit Committee.The Audit Committee consists of directors Donald T. Duke, Robert D. Hisrich and Ronald L. Siegenthaler, all of whom qualify as independent directors under Nasdaq’s current listing standards for audit committee membership. The Board of Directors has determined that the Committee has at least one “audit committee financial expert” serving on the Committee, Donald T. Duke. Mr. Duke is independent as that term is defined in Item 7(d)(3)(iv) of Schedule 14A under the Securities Exchange Act of 1934. The Audit Committee met fiveseven times independently of meetings of the Board of Directors during the 20042005 fiscal year.

The Committee operates under a written charter adopted by the Board of Directors. The Audit Committee assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. Among other things, the Audit Committee is responsible for selecting and retaining the Company’s independent public accountants; pre-approving the engagement of the independent accountants for all audit-related services and permissible, non-audit related services; reviewing in

3

advance the scope and focus of the annual audit; reviewing and discussing with management and the auditors the financial reports of the Company, the audited financial statements, the auditor’s report, the management letter and the quality and adequacy of the Company’s internal controls; and reviewing and approving all related-party transactions. A copy of the Audit Committee’s written charter was included as an appendix to the Company’s proxy statement for last year’s annual meeting, which was filed with the Securities and Exchange Commission during the 2004 fiscal year, on February 26, 2004.

Compensation Committee. The Compensation Committee consists of directors Ron B. Barber, Donald T. Duke, Robert D. Hisrich and Ronald L. Siegenthaler. All of the members except Mr. Barber are independent as defined by Nasdaq’s current listing standards for compensation committee membership. Mr. Barber serves on the Committee under an exception to such listing standards. In appointing Mr. Barber pursuant to this exception, the Board determined that Mr. Barber’s professional training as a lawyer and a certified public accountant, his vast experience in counseling a variety of businesses with regard to executive employment arrangements and equity ownership plans, and his former service to the Company as its Chief Financial Officer and Senior Vice President in the mid to late 1980’s, make him uniquely qualified to understand and provide guidance and advice with respect to the tasks for which the Committee is responsible. Under Nasdaq rules, Mr. Barber may not serve longer than two years on the Committee under this exception, which two year period will expire in April 2006.

The Compensation Committee works with Company management and provides advice and assistance to the Board regarding establishment of the Company’s compensation philosophy, objectives and strategy; administration of executive and management compensation programs; significant changes in employee benefit plans; executive employment and severance agreements; and appointments to the Committee. The Committee is also responsible for recommending for full Board approval the compensation of the Chairman and Chief Executive Officer, all other executive officers, and directors of the Company, and for providing an annual report on executive compensation to the Board. During fiscal 2005, the Compensation Committee did not meet independently of meetings of the Board of Directors. The Committee conducted its business during the 2005 fiscal year in conjunction with meetings of the Board, via telephone and e-mail communications, and by written Memorandum of Action.

Nominating Committee. The Company’s Nominating Committee was established on January 15, 2004 for the purpose of identifying and recommending nominees to the Board of Directors. Ronald L. Siegenthaler is the Committee’s Chairman and sole member, and is independent as defined by Nasdaq’s listing standards for nominating committee members. The Committee does not have specific minimum qualifications that must be met by a candidate for election to the Board of Directors in order to be considered for nomination by the Committee. In identifying and evaluating nominees for director, the Committee considers each candidate’s experience, integrity, background and skills, as well as any other qualities that the candidate may possess and factors that the candidate may be able to bring to the Board. The Company has not paid a fee to any third party for the identification or evaluation of candidates. To date, the Company has never received a recommendation from a shareholder for nomination to the Board. In light of this fact, the Nominating Committee does not have a formal process for receiving director nominations from shareholders, although the Board would consider any candidate proposed in good faith by a shareholder. A copy of the Nominating Committee’s charter was included as an appendix to the Company’s proxy statement filed with the Securities and Exchange Commission during the Company’s 2004 fiscal year, on February 26, 2004 in connection2004.

Communications with last year’s annual meeting. Directors

Compensation Committee.

The Compensation Committee consistsBoard of directors Ron B. Barber, Donald T. Duke, Robert D. Hisrich and Ronald L. Siegenthaler. All of the members except Mr. Barber are independent as defined by Nasdaq’s current listing standardsDirectors has not established a formal process for compensation committee membership. Mr. Barber serves on the Committee under an exceptionshareholders to such listing standards. In appointing Mr. Barber pursuantfollow to this exception, the Board determined that Mr. Barber’s professional training as a lawyer and a certified public accountant, his vast experience in counseling a variety of businesses with regard to executive employment arrangements and equity ownership plans, and his former service to the Company as its Chief Financial Officer and Senior Vice President in the mid to late 1980’s, make him uniquely qualified to understand and provide guidance and advice with respect to the tasks for which the Committee is responsible. Under Nasdaq rules, Mr. Barber may not serve longer than two years on the Committee under this exception. The Compensation Committee works with Company management and provides advice and assistancesend communications to the Board regarding establishment ofor its members, as the Company’s compensation philosophy, objectives and strategy; administration of executive and management compensation programs; significant changes in employee benefit plans; executive employment and severance agreements; and appointmentspolicy has been to forward to the Committee. The CommitteeBoard any shareholder correspondence it receives that is also responsible for recommending for full Board approval the compensation of the Chairman and Chief Executive Officer, all other executive officers, and directors of the Company, and for providing an annual report on executive compensationaddressed to the Board. During fiscal 2004,Directors. Shareholders who wish to communicate with the Compensation Committee did not meet independently of meetings ofDirectors may do so by sending their correspondence to the Board of Directors. The Committee conducted its business during the 2004 fiscal year in conjunction with meetings of the Board, via telephone and e-mail communications, and by written Memorandum of Action. Company’s headquarters at 1814 West Tacoma Street, Broken Arrow, Oklahoma 74012.

Director Compensation

The Company currently compensates its directors who are not officers of the Company $9,600 per year for Board membership. In addition, Board members serving on a Committee receive $8,000 per year and Board members serving as Chairman of a Committee receive an additional $16,000 per year. The Company also reimburses Mr. Duke and Dr. Hisrich, who are not residents of the Tulsa area, for travel expenses actually incurred to attend Board and Committee meetings and the Annual Shareholders’Shareholders Meeting.

5

The Company has also on occasion granted stock options to its outside directors. No such options were granted during the 20042005 fiscal year. The last grant of stock options to outside directors was made on November 1, 2001.

4

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee are those named above.identified above under the section entitled “Committees”. There are no “interlocks” (as defined by the rules of the Securities and Exchange Commission) with respect to any member of the Compensation Committee of the Board of Directors. No member of this Committee was at any time during the 20042005 fiscal year an officer or employee of the Company.

No member of the Committee is a former officer or employee of the Company, except as follows: Mr. Barber served as Chief Financial Officer and Senior Vice President of the Company from August 17, 1987 to March 1991, and is a shareholder in the law firm of Barber & Bartz, a Professional Corporation, which serves as outside general counsel to the Company; and Mr. Siegenthaler served as Executive Vice President of the Company from July 1990 to March 1999.

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Summary of Cash and Certain Other Compensation

The following table sets forth information concerning the compensation of the Company’s Chief Executive Officer and the Company’s other twothree executive officers.

SUMMARY COMPENSATION TABLE

Annual Compensation

Long Term Compensation

(a)

(b)

(c)

(d)

(e)

(g)

(i)

Name and

Principal Position

Year

Salary

Bonus

Other

Common Stock

Underlying

Options (#)

All

Other

Compensation (1)

Jack R. Ingram

2004

$

165,000

$

19,000

(2)

$

—

—

$

6,242

Chief Executive

2003

165,635

19,000

301,000

(3)

—

6,917

Officer

2002

165,725

17,000

486,000

(3)

35,000

8,000

Larry N. Patterson

2004

137,500

19,000

(2)

6,611

(4)

—

6,524

Executive Director

2003

138,029

19,000

10,577

(4)

—

6,695

of Operations

2002

137,991

14,000

7,932

(4)

25,000

6,394

Robert B. Wagner

2004

110,000

19,000

(2)

—

—

5,160

Chief Financial

2003

110,423

19,000

2,693

(4)

—

4,231

Officer

2002

110,393

14,000

—

25,000

4,974

(1)

Represents the Company’s contributions to the employee’s account under the Company’s 401(k) plan.

Annual Compensation

Long Term Compensation

(a)

(b)

(c)

(d)

(e)

(g)

(i)

Name and

Principal

Position

Year

Salary

Bonus

Other

Common Stock

Underlying

Options (#)

All

Other

Compensation (1)

Jack R. Ingram

2005

$

143,539

$

13,300

(2)

$

—

—

$

8,571

Chief Executive

2004

165,000

19,000

—

—

6,242

Officer

2003

165,635

19,000

301,000

(3)

—

6,917

Greg D. Forrest (4)

2005

136,212

18,862

(4)

75,177

(5)

—

—

President

2004

30,000

—

—

—

—

Larry N. Patterson

2005

138,029

13,300

(2)

7,933

(6)

—

6,598

Executive

Director of

2004

137,500

19,000

6,611

(6)

—

6,524

Operations

2003

138,029

19,000

10,577

(6)

—

6,695

Robert B. Wagner

2005

110,423

13,300

(2)

—

—

4,990

Chief Financial

2004

110,000

19,000

—

—

5,160

Officer

2003

110,423

19,000

2,693

(6)

—

4,231

(2)

Represents bonus amount awarded for 2004 fiscal year performance, to be paid in quarterly installments. Bonus payments are subject to forfeiture if the employee is not employed at the time of payment.

(3)

Represents the dollar value of the difference between the price paid for shares of the Company’s common stock upon exercise of stock options and the market value of such stock on the date of exercise.

(4)

Represents unused vacation time for which the employee was paid in cash.

|

|

|

|

| Annual Compensation |

| Long Term Compensation |

|

|

|

| ||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||

(a) |

| (b) |

| (c) |

| (d) |

| (e) |

| (g) |

| (i) |

| ||||||

Name and |

| Year |

| Salary |

| Bonus |

| Other |

| Common Stock |

| All |

| ||||||

|

|

|

|

|

|

| |||||||||||||

Jack R. Ingram |

|

| 2004 |

| $ | 165,000 |

| $ | 19,000 | (2) | $ | — |

|

| — |

| $ | 6,242 |

|

Chief Executive |

|

| 2003 |

|

| 165,635 |

|

| 19,000 |

|

| 301,000 | (3) |

| — |

|

| 6,917 |

|

Officer |

|

| 2002 |

|

| 165,725 |

|

| 17,000 |

|

| 486,000 | (3) |

| 35,000 |

|

| 8,000 |

|

Larry N. Patterson |

|

| 2004 |

|

| 137,500 |

|

| 19,000 | (2) |

| 6,611 | (4) |

| — |

|

| 6,524 |

|

Executive Director |

|

| 2003 |

|

| 138,029 |

|

| 19,000 |

|

| 10,577 | (4) |

| — |

|

| 6,695 |

|

of Operations |

|

| 2002 |

|

| 137,991 |

|

| 14,000 |

|

| 7,932 | (4) |

| 25,000 |

|

| 6,394 |

|

Robert B. Wagner |

|

| 2004 |

|

| 110,000 |

|

| 19,000 | (2) |

| — |

|

| — |

|

| 5,160 |

|

Chief Financial |

|

| 2003 |

|

| 110,423 |

|

| 19,000 |

|

| 2,693 | (4) |

| — |

|

| 4,231 |

|

Officer |

|

| 2002 |

|

| 110,393 |

|

| 14,000 |

|

| — |

|

| 25,000 |

|

| 4,974 |

|

(1)

Represents the Company’s contributions to the employee’s account under the Company’s 401(k) plan.

|

|

|

| Annual Compensation |

| Long Term Compensation |

|

|

| ||||||||

(a) |

| (b) |

| (c) |

| (d) |

| (e) |

| (g) |

| (i) |

| ||||

Name and |

| Year |

| Salary |

| Bonus |

| Other |

| Common Stock |

| All |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Jack R. Ingram |

| 2005 |

| $ | 143,539 |

| $ | 13,300 | (2) | $ | — |

| — |

| $ | 8,571 |

|

Chief Executive |

| 2004 |

| 165,000 |

| 19,000 |

| — |

| — |

| 6,242 |

| ||||

Officer |

| 2003 |

| 165,635 |

| 19,000 |

| 301,000 | (3) | — |

| 6,917 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Greg D. Forrest (4) |

| 2005 |

| 136,212 |

| 18,862 | (4) | 75,177 | (5) | — |

| — |

| ||||

President |

| 2004 |

| 30,000 |

| — |

| — |

| — |

| — |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Larry N. Patterson |

| 2005 |

| 138,029 |

| 13,300 | (2) | 7,933 | (6) | — |

| 6,598 |

| ||||

Executive Director of |

| 2004 |

| 137,500 |

| 19,000 |

| 6,611 | (6) | — |

| 6,524 |

| ||||

Operations |

| 2003 |

| 138,029 |

| 19,000 |

| 10,577 | (6) | — |

| 6,695 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Robert B. Wagner |

| 2005 |

| 110,423 |

| 13,300 | (2) | — |

| — |

| 4,990 |

| ||||

Chief Financial |

| 2004 |

| 110,000 |

| 19,000 |

| — |

| — |

| 5,160 |

| ||||

Officer |

| 2003 |

| 110,423 |

| 19,000 |

| 2,693 | (6) | — |

| 4,231 |

| ||||

(2)

Represents bonus amount awarded for 2004 fiscal year performance, to be paid in quarterly installments. Bonus payments are subject to forfeiture if the employee is not employed at the time of payment.

(3)

Represents the dollar value of the difference between the price paid for shares of the Company’s common stock upon exercise of stock options and the market value of such stock on the date of exercise.

(4)

Represents unused vacation time for which the employee was paid in cash.

6

(1) Represents the Company’s contributions to the employee’s account under the Company’s 401(k) plan.

(2) Represents bonus amount awarded for 2005 fiscal year performance, to be paid in quarterly installments. Bonus payments are subject to forfeiture if the employee is not employed at the time of payment.

(3) Represents the dollar value of the difference between the price paid for shares of the Company’s common stock upon exercise of stock options and the market value of such stock on the date of exercise.

(4) Mr. Forrest became President on July 6, 2005. Prior to that date, he was employed by the Company as Director of Sales of the Company’s Seattle branch office since joining the Company in August 2004. His bonus consists of (i) $3,325 awarded for 2005 fiscal year performance in his capacity as President, and (ii) $15,537, representing 2% of the gross profits of the Seattle Branch Office during his service as Director of Sales of such office, which was paid pursuant to the terms of his employment agreement in such capacity.

5

(5) Represents $71,300 in relocation expenses paid on behalf of Mr. Forrest, and $3,877 in commissions earned by Mr. Forrest while he was still Director of Sales of the Company’s Seattle branch office.

(6) Represents unused vacation time for which the employee was paid in cash.

Stock Options

There were no stock options or stock appreciation rights granted during the 20042005 fiscal year to any of the persons named in the Summary Compensation Table.

Option Exercises and Holdings

The following table sets forth certain information regarding stock options exercised during the 20042005 fiscal year by persons named in the Summary Compensation Table and the number and value of unexercised options held by such persons as of the fiscal year-end. The Company has not granted stock appreciation rights.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND

FY-END OPTION VALUES

(a) |

| (b) |

| (c) |

| (d) |

| (e) |

| |||||

|

| Shares Acquired |

| Value Realized |

| Number of Securities |

| Value of Unexercised |

| |||||

Name |

| on Exercise (#) |

| ($ ) |

| Exercisable |

| Unexercisable |

| Exercisable |

| Unexercisable |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Jack R. Ingram |

| — |

| — |

| 35,000 |

| — |

| $ | — |

| — |

|

Greg D. Forrest |

| — |

| — |

| — |

| — |

| — |

| — |

| |

Larry N. Patterson |

| — |

| — |

| 125,000 |

| — |

| — |

| — |

| |

Robert B. Wagner |

| — |

| — |

| 93,000 |

| — |

| 21,581 |

| — |

| |

(a) |

| (b) |

| (c) |

| (d) |

| (e) |

| ||||||||||

|

|

|

|

|

|

|

| Number of Securities |

| Value of Unexercised |

| ||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||

Name |

| Shares Acquired |

| Value Realized |

| Exercisable |

| Unexercisable |

| Exercisable |

| Unexercisable |

| ||||||

|

|

|

|

|

|

| |||||||||||||

Jack R. Ingram |

|

| — |

|

| — |

|

| 35,000 |

|

| — |

| $ | — |

|

| — |

|

Larry N. Patterson |

|

| — |

|

| — |

|

| 125,000 |

|

| — |

|

| — |

|

| — |

|

Robert B. Wagner |

|

| — |

|

| — |

|

| 93,000 |

|

| — |

|

| 58,500 |

|

| — |

|

|

|

(1) Based upon the difference between the fair market value of the securities underlying the “in-the-money” options at fiscal year-end ($2.36 per share) and the exercise price. Options are in-the-money options if the fair market value of the securities underlying the options exceeds the exercise price of the options.

Employment Agreements

The Company has no formal employment agreements with any of the officers named in the Summary Compensation Table.

6

COMPENSATION COMMITTEE REPORT

The Compensation Committee is the focal point for senior management and the Board of Directors to address corporate compensation issues. The Committee’s primary responsibility is to make recommendations to the Board regarding remuneration of executive officers and to evaluate the design and competitiveness of the Company’s compensation plans. The Committee consists of three independent directors and a fourth director who is affiliated with the Company’s outside counsel.

Compensation Philosophy. The heart of the Company’s compensation philosophy is the enhancement of shareholder value. Consequently, the interests of shareholders and the need to be competitive in recruiting and retaining quality managers and to motivate management to improve shareholder value drive the design of executive compensation programs. A primary component of the Company’s compensation philosophy is to structure compensation programs so that a high percentage of remuneration is “at risk”. Near term cash compensation reflects corporate performance and larger long-term incentives are tied directly to share value.

7

Executive Compensation Program.Compensation for executive officers is comprised of base salary, competitive employee benefits, an annual incentive compensation opportunity, and a long-term incentive in the form of equity based awards. Under the Company’s incentive compensation program, the higher an executive’s level of responsibility, the greater his compensation will be dependent on performance.

The Compensation Committee reviews executive compensation levels with respect to corporate and individual performance, as well as competitive pay practices. The Company’s Human Resources Department assists the Committee in this analysis and, in the past, the Committee has, also, retained the services of a third party compensation-consulting firm. In addition, the Committee considers general industry conditions, as well as the Company’s recent recruiting experiences. From its review, the Committee believes the Company’s executive compensation program to be generally competitive with similarly situated companies.

The Committee reviews annually the base salaries of XETA’s executive officers and recommends any adjustments it may deem appropriate, for approval by the full Board of Directors. In its review, the Committee takes into account individual factors such as: experience; performance, both during the preceding twelve months and future potential; retention considerations; and othersother issues particular to the executive and XETA. Additionally, the Committee considers the growth and performance of the Company as it assesses the market basis for executive salaries.

During

Although XETA believes its business prospects improved during fiscal year 2004, XETA2005, the Company continued to experience pressure on gross margins, and while some traction was gained with top line growth initiatives, the Company’sas a result, XETA’s bottom line goals were not achieved. Therefore, the freeze instituted in 2001 on salaries of senior executives and the cash compensation of directors remains in effect. In fiscal year 2001,effect, as does the Company suspended indefinitely itssuspension of the Company’s defined incentive compensation program for non-sales employees due to poor business visibility. Although fiscal year 2004 saw some gradual improvement in the economy, this suspension remains in effect. employees.

However, the Company still believes it is essential to appropriately recognize the leadership and sacrifice of many of its key employees. To achieve that recognition, the Board, again, authorized a small discretionary bonus pool ($235,700).of $146,405. From the pool, a total of $57,000$43,225 was awarded to the Company’s threefour senior officers with the remaining $178,700$103,180 being distributed to numerous other key employees. In keeping with the Company’s compensation philosophy, the Committee will continue to support this practice at current levels of profitability. Additionally, as the Company returns to healthy business growth, the Committee believes a new incentive compensation program for senior executives will be necessary. To that end, it is evaluating a plan based on a percentage of pre-tax net income and its growth.

As a long-term incentive, the Company has in the past granted options to purchase shares of Common Stock to directors, executive officers, and other key employees. These stock options have been awarded in two ways under plans approved by the Board of Directors. The first is under the shareholder approved stock option plans, and the second is through special grants of non-qualified options. Most of the grants are subject to a vesting period and carry a ten-year exercise term. Additionally, strike prices for grants are determined by the closing market price of the Company’s stock on the date of the grant.

Although the Company granteddid not grant any new incentive options for only 1,500 shares during fiscal year 2004,2005, the Company’s employees currently holdheld valid, vested, and unexercised option grants for a total of 1,243,5721,158,272 shares of common stock and are vested in options for 1,242,072 shares.as of October 31, 2005. Of these totals the Company’s executives presently possesspossessed option grants for 253,000 shares, all of

7

which are vested. The strike prices of the option grants currently outstanding range from a high of $18.13 per share to a low of $0.31$1.64 per share.

The Committee believes that stock options are a very effective compensation tool for the purpose of enhancing shareholder value. However, new regulations regarding financial accounting for options has significantly reduced their usefulness as a compensation tool for smaller companies such as XETA. Therefore, the Company developed the 2004 Omnibus Stock Incentive Plan, approved by the shareholders at lastthat year’s annual meeting. Under the new plan, the Company can now award executives and other employees many forms of incentive equity compensation, such as SAR’s, Phantom Stock, Restricted Stock, Stock Bonuses, and Stock Options. The Company has not yet made any awards under this new plan.

20042005 CEO Compensation.The compensation package for the Company’s CEO, Mr. Jack Ingram, is consistent in all material aspects with the program for the Company’s other executive officers. His current annual base salary isduring most of fiscal year 2005 was $165,000, downthe same amount he has received since fiscal 2001, when his salary was reduced from $220,000 as part of the fiscal year 2001 reductions discussed earlier. Additionally, he was granted a cash bonus of $19,000$13,300 for his performance during fiscal year 20042005 from the small Board-authorized discretionary bonus pool, outlined above. During the fourth quarter, the Company promoted Mr. Greg Forrest to the position of President and Chief Operating Officer. As a result, Mr. Ingram relinquished those duties, and his annual base salary was adjusted to $120,000. He retains the duties of Chairman of the Board and CEO.

8

As part of his original compensation package with the Company at the time of his employment in 1990, Mr. Ingram was granted options to purchase an aggregate of 200,000 shares of Common Stock pursuant to a special non-qualified grant approved by the Board of Directors. These options, which had a 10-year exercise period, were subsequently adjusted proportionately in number and exercise price in accordance with a 2-for-1 stock split in 1999 and a 2-for-1 stock split in 2000. At this time, Mr. Ingram has fully exercised these options. On November 1, 2001, he was granted an additional option to purchase 35,000 shares of the Company’s stock at a price of $3.63 per share. He vested in this grant on November 1, 2004. Mr. Ingram has purchased the balance of his stock holdings in the Company on the open market.

In evaluating the compensation package of the Company’s CEO, the Committee considers such factors as XETA’s strategic and financial performance, his compensation in relation to that of CEO’s at other comparable companies, his personal contribution to XETA’s success, and the Company’s overall executive compensation philosophy. For fiscal year 2004,2005, the Committee believes the compensation package of the CEO was consistent with the Company’s objectives.

Conclusion.The Compensation Committee believes the Company’s executive compensation program has been consistent with the philosophy outlined in this report and has been effective overall in achieving its objectives during fiscal 2004.2005. The Committee hereby submits this report to XETA’s Board of Directors for approval.

The Compensation Committee,

| |

| |

| |

| |

|

9Donald T. Duke, Chairman

Ron B. Barber

Robert D. Hisrich

Ronald L. Siegenthaler

PROPOSAL 2

INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee has selected Grant ThorntonTullius Taylor Sartain & Sartain LLP (“GT”TTSS”) as the independent public accountants to perform an integrated audit of the Company’s financial statements and of the internal controls over financial reporting for the fiscal year ending October 31, 2005.2006. Representatives of GTTTSS are expected to be present at the Annual Meeting with the opportunity to make a statement if they desire to do so and to respond to appropriate questions. While ratification of the Company’s selection of accountants by the Company’s shareholders is not required, in the event of a negative vote on such ratification, the Company’s Audit Committee will reconsider its selection. Even if the selection is ratified, the Audit Committee in its discretion may change the appointment at any time during the year if it determines that such change would be in the best interests of the Company and its

8

shareholders. GTTTSS audited the Company’s financial statements for the fiscal year ended October 31, 2005. TTSS was engaged by the Company on May 13, 2005.

The Company’s financial statements for the fiscal years ended October 31, 2004 and 2003. 2003 were audited by Grant Thornton LLP. Grant Thornton LLP was the Company’s independent public accountants from August 9, 2002 through May 5, 2005, when the Audit Committee dismissed Grant Thornton as the Company’s independent auditors. The decision to discontinue Grant Thornton’s engagement was the result of a competitive bidding process initiated by the Company in an effort to reduce the overall cost of its audit services.

The reports of Grant Thornton on the Company’s consolidated financial statements for each of its last two completed fiscal years prior to Grant Thornton’s dismissal did not contain an adverse opinion or disclaimer of opinion, nor were those reports qualified or modified as to uncertainty, audit scope or accounting principles, except that the report relating to the October 31, 2003 financial statements dated December 5, 2003 (except for the “Stock Based Compensation Plans” section of Note 1, as to which the date is June 3, 2004), included an explanatory paragraph stating that subsequent to the initial issuance of the 2003 financial statements, management determined that certain provisions of Statement of Financial Accounting Standards No. 123, Accounting for Stock-Based Compensation (SFAS 123), relating to computing the pro forma impact of issued stock options, were misapplied, and that the pro forma disclosures in the “Stock Based Compensation Plans” section of Note 1 to the 2003 consolidated financial statements had been revised to correct the previously reported pro forma disclosures.

During the two most recent fiscal years preceding its dismissal and the subsequent interim period from November 1, 2004 through May 5, 2005, (a) there were no disagreements with Grant Thornton on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure that, if not resolved to the satisfaction of Grant Thornton, would have caused them to make reference to the subject matter in connection with their report on the Company’s consolidated financial statements for such years, and (b) there were no “reportable events” as defined in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

The Company has also made the foregoing disclosures regarding Grant Thornton in a Current Report on Form 8-K which it filed with the Securities and Exchange Commission on May 9, 2005. In connection therewith, the Company provided a copy of the foregoing disclosures to Grant Thornton and requested that Grant Thornton furnish it with a letter addressed to the Securities and Exchange Commission stating whether or not it agrees with the statements in such Form 8-K. A copy of Grant Thornton’s letter furnished in response to that request is filed as Exhibit 16.1 to the Company’s Current Report on Form 8-K filed with the Commission on May 9, 2005.

Fees and Independence

Audit Fees. GTTTSS billed the Company an aggregate of $115,045 and $80,500 for the 2004 and 2003 fiscal years, respectively,$75,000 for professional services rendered for the audit of the Company’s financial statements for thosethe fiscal yearsyear ended October 31, 2005 and to review the Company’s financial statements included in the Company’s FormsForm 10-Q during thosefor the second and third quarters of fiscal years.2005. Prior to the dismissal of Grant Thornton, the Company paid Grant Thornton $12,075 for professional services rendered in conjunction with the review of the Company’s financial statements included in the Form 10-Q for the first of fiscal 2005, and $115,045 for the audit of the Company’s financial statements for the fiscal year ended October 31, 2004.

Audit Related Fees. GT TTSS billed the Company $7,000 in each of the fiscal years 2005 and 2004 for audit-related services not included in the preceding paragraph. These services related to the audit of the Company’s 401(k) retirement plan. Grant Thornton billed the Company $9,900 in fiscal 2004 for audit-related services not included in the preceding paragraph. GT did not billThese services related to services associated with the Company for any such services duringCompany’s filing of a registration statement on Form S-8, and training provided on software related to the 2003 fiscal year.Company’s implementation of certain requirements under the Sarbanes-Oxley Act of 2002.

Tax Fees. GT did not billNeither TTSS nor Grant Thornton billed the Company for any tax consulting or related services during the 20042005 and 20032004 fiscal years.

All Other Fees. GT did not bill Neither TTSS nor Grant Thornton billed the Company for any other products or services not included in the preceding paragraphs during the 20042005 and 20032004 fiscal years.

9

The Audit Committee of the Board of Directors has established a written policy to pre-approve audit and non-audit related services to be provided by the Company’s independent auditor prior to engaging the auditor for such purposes. Pursuant to the policy, the Audit Committee will annually review the services and fees that the auditor may provide to the Company during the following 12 months. Following such review, the Committee will issue a statement to the Company’s Chief Financial Officer as to the general services and fees that the Committee has pre-approved. The pre-approval generally extends for a period of 12 months or such shorter period as may be specifically indicated by the Committee. All other services to be performed by the auditors that are not included in the Committee’s annual pre-approval statement must be submitted to the Committee in advance for specific approval.

RECOMMENDATIONRecommendation

The Board of Directors unanimously recommends that shareholders vote “For”FOR the appointment of Grant ThorntonTullius Taylor Sartain & Sartain LLP as the Company’s independent public accountants.

REPORT OF AUDIT COMMITTEE

January 15, 200526, 2006

To the Board of Directors of XETA Technologies, Inc.:

The Audit Committee oversees XETA’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. We have reviewed and discussed with management and with the independent auditors the Company’s audited financial statements as of and for the year ended October 31, 2004.2005.

We have discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants.

10

We have received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standard No. 1, Independence Discussions with Audit Committees, as amended, by the Independence Standards Board, and have discussed with the auditors the auditors’ independence.

Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the year ended October 31, 2004.2005.

| |

| |

| |

|

The Audit Committee,

Donald T. Duke, Chairman

Ronald L. Siegenthaler

Robert D. Hisrich

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information known to the Company as of January 17, 2006 regarding beneficial ownership of the Company’s Common Stock, par value $.001 per share, by (a) each person known by the Company to own more than five percent (5%) of the Company’s Common Stock, (b) each director and nominee for election as a director of the Company, (c) each executive officer named in the Summary Compensation Table, and (d) all directors and executive officers of the Company as a group.

Name and Address |

| Amount and Nature |

| Percent of |

|

|

|

|

|

|

|

Directors and Executive Officers |

|

|

|

|

|

|

|

|

|

|

|

Ronald L. Siegenthaler |

| 1,117,003 | (3) | 10.93 | % |

P.O. Box 571300 |

|

|

|

|

|

Tulsa, OK 74157 |

|

|

|

|

|

|

|

|

|

|

|

Jack R. Ingram |

| 1,066,579 | (4) | 10.41 | % |

|

|

|

|

|

|

Larry N. Patterson |

| 154,918 | (5) | 1.50 | % |

|

|

|

|

|

|

Ron B. Barber |

| 118,472 |

| 1.16 | % |

525 S. Main Street, Suite 800 |

|

|

|

|

|

Tulsa, OK 74103 |

|

|

|

|

|

|

|

|

|

|

|

Greg D. Forrest |

| 100,000 | (6) | 1.0 | % |

|

|

|

|

|

|

Robert B. Wagner |

| 78,882 | (7) | * |

|

|

|

|

|

|

|

Robert D. Hisrich |

| 56,550 |

| * |

|

15249 North 59th Ave. |

|

|

|

|

|

Glendale, AZ 85306 |

|

|

|

|

|

|

|

|

|

|

|

Donald T. Duke |

| 54,500 |

| * |

|

1505 Vandivort |

|

|

|

|

|

Edmond, OK 73034 |

|

|

|

|

|

|

|

|

|

|

|

All officers and directors as a group |

| 2,746,904 |

| 26.19 | % |

(8 persons) |

|

|

|

|

|

|

|

|

|

|

|

Others Known to Own 5% |

|

|

|

|

|

|

|

|

|

|

|

FMR Corp. |

| 974,969 | (8) | 9.55 | % |

82 Devonshire St. |

|

|

|

|

|

Boston, MA 02109 |

|

|

|

|

|

|

|

|

|

|

|

Jon A. Wiese |

| 580,000 | (9) | 5.37 | % |

11509 S. Granite Ave. |

|

|

|

|

|

Tulsa, OK 74137 |

|

|

|

|

|

|

|

|

|

|

|

Walrus Partners, L.L.C. |

| 650,221 | (10) | 6.4 | % |

8014 Olson Memorial, #232 |

|

|

|

|

|

Golden Valley, MN 55427 |

|

|

|

|

|

11

*Less than one percent of the shares outstanding.

(1) Address is that of the Company’s principal office at 1814 W. Tacoma Street, Broken Arrow, Oklahoma 74012 unless otherwise indicated.

(2) Except as indicated in the footnotes to this table, the persons named in the table have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to community property laws where applicable. The number of shares beneficially owned includes the number of shares of Common Stock that such persons presently have the right to acquire pursuant to unexercised options under the Company’s stock option plans, as follows: 13,000 shares for Mr. Siegenthaler; 35,000 shares for Mr. Ingram; 125,000 shares for Mr. Patterson; 13,000 shares for Mr. Barber; 63,000 shares for Mr. Wagner; 13,000 shares for Dr. Hisrich; 17,000 shares for Mr. Duke; and 279,000 shares for all directors and executive officers as a group (8 persons).

(3) Includes 129,000 shares held by Mr. Siegenthaler’s wife’s trust.

(4) Includes 10,000 shares held by Mr. Ingram’s wife.

(5) Includes 9,280 shares, the equivalent number of shares held as units for Mr. Patterson’s account by the Company’s 401(k) retirement plan, over which Mr. Patterson has shared investment power and no voting power.

(6) Shares held by Bluejack Systems LLC, a limited liability company owned by Mr. Forrest.

(7) Includes 4,400 shares held by Mr. Wagner as custodian for his minor children, over which he has sole voting and investment power, and 3,482 shares, the equivalent number of shares held as units for Mr. Wagner’s account by the Company’s 401(k) retirement plan, over which Mr. Wagner has shared investment power and no voting power.

(8) This information is based upon a Schedule 13G dated February 14, 2005 filed with the Securities and Exchange Commission jointly by FMR Corp., Edward C. Johnson 3d, Abigail P. Johnson, Fidelity Management & Research Company, and Fidelity Low Priced Stock Fund. According to the Schedule 13G: FMR Corp. is a parent holding company of Fidelity Management & Research Company (“Fidelity”). Fidelity, as a result of acting as an investment adviser to various investment companies, including Fidelity Low Priced Stock Fund (the “Fund”), is the beneficial owner of these 974,969 shares. Members of the Edward C. Johnson 3d family, including Abigail Johnson, may be deemed to form a controlling group with respect to FMR Corp. by reason of their ownership of approximately 49% of the voting power of FMR Corp. and a shareholders’ voting agreement among them and the other shareholders of the voting stock of FMR Corp. Edward C. Johnson 3d, FMR and the Fund each has sole investment power over the 974,969 shares of XETA stock shown above. Neither FMR Corp. nor Mr. Johnson has sole voting power over such shares, as that power resides with the Fund’s Board of Trustees.

(9) Reflects options which are presently exercisable. Mr. Wiese is shown as a 5% beneficial owner solely by reason of these outstanding options, of which the Company has direct knowledge. Except for these outstanding options, the Company has no other information or knowledge regarding Mr. Wiese’s security holdings, if any, in the Company.

(10) This information is based upon a Schedule 13G dated February 9, 2006 filed with the Securities and Exchange Commission by Walrus Partners, L.L.C. According to the Schedule 13G, Walrus Partners is an investment adviser registered with the State of Minnesota and as such, may be deemed to possess sole voting and dispositive power over these shares, which are owned by its investment advisory clients. The Schedule 13G further notes that not more than 5% of the common stock of the Company is beneficially owned by any one client whom Walrus Partners advises. The Schedule 13G further states that Walrus Partners disclaims beneficial ownership of any securities held by its investment advisory clients.

12

RELATED TRANSACTIONS

Mr. Barber is a shareholder in the law firm of Barber & Bartz, a Professional Corporation, which serves as outside general counsel to the Company. During the fiscal year ended October 31, 2004,2005, the Company paid legal fees to Barber & Bartz in the approximate amount of $152,000.$183,606. Mr. Barber was also paid $8,000 during the fiscal year by the Audit Committee for serving in an advisory role to the Audit Committee.

A son of CEO and director Jack Ingram is employed by the Company as a sales representative and ranked as the Company’s fourth most productive sales representative in fiscal 2005. A son of director Ron Siegenthaler is employed by the Company as a sales representative and ranked in the top one-third of all sales representatives of the Company in fiscal 2005. Both receive a base salary and commissions in accordance with the Company’s standard compensation plan for all sales representatives in their respective lines of business. The payments made to these individuals are made in the ordinary course of business. Neither the CEO nor the director has a material interest in the employment relationships, nor does either of them share a home with these employees. Neither of these employees is an executive officer of the Company.

13

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Based solely upon a review of (i) Forms 3 and 4 and amendments thereto furnished to the Company during its most recent fiscal year, (ii) Forms 5 and amendments thereto furnished to the Company with respect to its most recent fiscal year, and (iii) written representations made to the Company by its directors and officers, the Company knows of no director, officer, or beneficial owner of more than ten percent of the Company’s Common Stock who has failed to file on a timely basis reports of beneficial ownership of the Company’s Common Stock as required by Section 16(a) of the Securities Exchange Act of 1934, as amended.

11

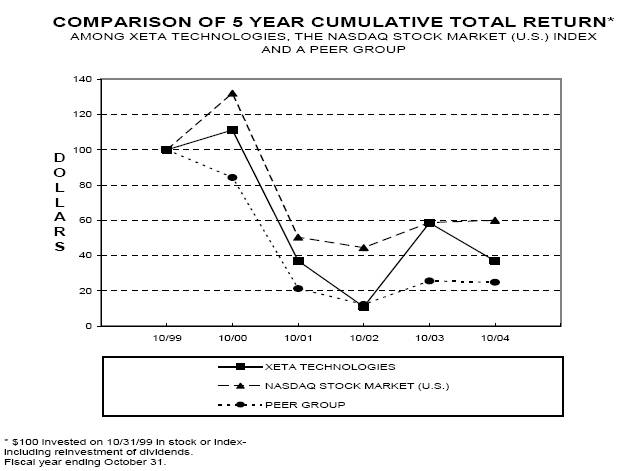

STOCK PERFORMANCE GRAPH

The following graph depicted below shows the Company’s stock price as an index assuming $100 invested on November 1, 1999,2000, along with the composite prices of companies listed in the SIC Code (Telephone, Telegraph Apparatus) Index and the Nasdaq Market Index.

|

| 1999 |

| 2000 |

| 2001 |

| 2002 |

| 2003 |

| 2004 |

| ||||||

|

|

|

|

|

|

|

| ||||||||||||

XETA TECHNOLOGIES, INC. |

|

| 100.00 |

|

| 111.26 |

|

| 37.04 |

|

| 11.01 |

|

| 58.65 |

|

| 36.94 |

|

SIC CODE INDEX |

|

| 100.00 |

|

| 132.14 |

|

| 50.42 |

|

| 44.50 |

|

| 58.73 |

|

| 60.03 |

|

NASDAQ MARKET INDEX |

|

| 100.00 |

|

| 84.32 |

|

| 21.26 |

|

| 12.24 |

|

| 25.62 |

|

| 24.90 |

|

|

| 2000 |

| 2001 |

| 2002 |

| 2003 |

| 2004 |

| 2005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

XETA TECHNOLOGIES |

| 100.00 |

| 33.29 |

| 9.90 |

| 52.72 |

| 33.20 |

| 21.83 |

|

NASDAQ MARKET INDEX |

| 100.00 |

| 50.31 |

| 40.68 |

| 59.03 |

| 60.22 |

| 65.22 |

|

SIC CODE INDEX |

| 100.00 |

| 23.41 |

| 8.59 |

| 18.27 |

| 16.79 |

| 14.32 |

|

14

SHAREHOLDER PROPOSALS AND COMMUNICATIONS WITH DIRECTORS

Under regulations of

Any shareholder who intends to submit a proposal pursuant to Rule 14a-8 under the Securities and Exchange Commission, shareholders are entitled to submit proposals on matters appropriate for shareholder action at subsequent Annual MeetingsAct of the Company in accordance with those regulations. In order for shareholder proposals for the Company’s next Annual Meeting to be eligible for consideration1934 (the “Exchange Act”) for inclusion in the proxy statement and proxy relating to suchmaterials for our 2007 annual meeting theyof shareholders, must beensure that the proposal is received by the Companyour Corporate Secretary no later than October 15, 2005.November 9, 2006. Such proposals should be directedsent to the attention of Corporate Secretary at XETA Technologies, Inc., 1814 WestW. Tacoma Street, Broken Arrow, Oklahoma 74012, Attention: CEO.74012.

Any shareholder wishing to submit a proposal intended to be presented at our 2007 annual meeting of shareholders that is not submitted pursuant to Exchange Act Rule 14a-8 should provide written notice of the proposal to our Corporate Secretary at the address noted above. The Board of Directors has not established a formal process for shareholdersSecretary must receive this notice no later than January 23, 2007. The persons designated in the proxy card will be granted discretionary authority with respect to follow to send communications to the Board or its members, as the Company’s policy has been to forward to the Board any shareholder correspondence it receives that is addressedproposal not timely submitted to the Directors. Shareholders who wish to communicate with the Directors may do so by sending their correspondence to the Company’s headquarters at 1814 West Tacoma, Broken Arrow, OK 74012.us.

12

CORPORATE GOVERNANCE—CODE OF CONDUCTETHICS

The Company has adopted a financial officer Code of Ethics applicable to the Chief Executive Officer, Chief Financial Officer, and any principal accounting officer, controller and other persons performing similar functions. A copy of this Code of Ethics is posted on the Company’s website at www.xeta.com under the Investor Relations section, and was previously filed with the Securities and Exchange Commission as Appendix D to the Company’s proxy statement for last year’s annual meeting.filed on February 26, 2004.

ANNUAL REPORT ON FORM 10-K

A complete copy of the Company’s annual report on Form 10-K, excluding exhibits, is included in the Annual Report provided to shareholders concurrently with this Proxy Statement. The Company will provide a copy of any exhibits to the Form 10-K to any shareholder who requests a copy and pays the Company’s reasonable expenses in furnishing such copy. The Company will advise the shareholder of the specific amount of such expenses after receiving the request. Shareholders may submit their requests to Corporate Secretary, XETA Technologies, Inc., 1814 W. Tacoma Street, Broken Arrow, OKOklahoma 74012.

NO INCORPORATION BY REFERENCE

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings made by the Company under those statutes, the preceding Compensation Committee Report on Executive Compensation, Audit Committee Report, and the Stock Performance Graph will not be incorporated by reference into any of those prior filings, nor will such reports or graph be incorporated by reference into any future filings made by the Company under those statutes.

15

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors knows of no matter other than those described herein that will be presented for consideration at the Annual Meeting. However, should any other matters properly come before the Annual Meeting or any adjournment thereof, it is the intention of the persons named in the accompanying Proxyproxy to vote in accordance with their best judgment in the interest of the Company.judgment.

By Order of the Board of Directors | |||

| |||

| |||

|

|

| |

Wagner |

| ||

| |||

Broken Arrow, OklahomaFebruary 18, 2005

13

XETA TECHNOLOGIES, INC.PROXY FOR ANNUAL MEETING OF SHAREHOLDERS

VOTING INSTRUCTIONS

YOU CAN VOTE IN ONE OF TWO WAYS:

Your vote is important. Please vote as soon as possible.

Vote-by-Internet

Log on to the Internet and go to http://www.eproxyvote.com/xeta

|

|

|

| |

|

| |

| |

| |

IF YOU ARE NOT VOTING BY INTERNET, DETACH PROXY CARD AND RETURN.

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder. If no direction is made, this proxy will be voted for the two foregoing proposals.

| ||

| ||

| ||

| ||

| ||

|

| |

|

| |

Secretary | ||

XETA TECHNOLOGIES, INC.

PROXY FOR ANNUAL MEETING OF SHAREHOLDERSBroken Arrow, Oklahoma

April 12, 2005

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORSFebruary 14, 2006

16

| c/o UMB Bank, N.A. |

YOUR VOTE IS IMPORTANT

Regardless of whether you plan to attend the Annual Meeting of Shareholders, you can be sure your shares are represented at the meeting by promptly returning your proxy in the enclosed envelope.

ê Please fold and detach card at perforation before mailing. ê

| XETA TECHNOLOGIES, INC |

This proxy is solicited on behalf of the Board of Directors for the | |

Annual Meeting of Shareholders to be held on Tuesday, April 4, 2006. |

The undersigned hereby appoints Jack R. Ingram and Robert B. Wagner, or either of them, as proxies and attorneys for the undersigned (with full power to act alone and to designate substitutions), hereby revoking any prior Proxy, and hereby authorizes them to represent the undersigned and to vote as designated below,on the reverse side, all the shares of Common Stock of XETA Technologies, Inc. held of record by the undersigned on February 25, 200521, 2006 at the Annual Meeting of Shareholders to be held on April 12, 2005,4, 2006, or any adjournment or postponement thereof.

Dated: | 2006 | ||

Signature | |||

Signature (if held jointly) | |||

NOTE: Signature(s) should follow exactly as name appears on your stock certificate. In case of joint ownership, each owner should sign. Executors, administrators, guardians, trustees, etc., should add their title as such and where more than one executor, etc. is named, a majority must sign. If signer is a corporation, please sign full corporate name by duly authorized officer. | |||

PLEASE DATE, SIGN AND RETURN THE PROXY CARD PROMPTLY, USING THE ENCLOSED ENVELOPE..

ê Please fold and detach card at perforation before mailing. ê

XETA TECHNOLOGIES, INC.. | PROXY |

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder. If no direction is made, this proxy will be voted FOR the two following proposals.

The Board of Directors recommends a vote FOR Items 1 and 2.

1. | ELECTION OF DIRECTORS: | |||||||

|

| |||||||

o | FOR all nominees listed above | o | WITHHOLD AUTHORITY | |||||

|

| (except those specified in the space below) | for all nominees listed above | |||||

| ( | |||||||

| ||||||||

2. | PROPOSAL TO RATIFY THE SELECTION OF | |||||||

|

|

|

|

|

| ||||

|

| oFOR | oAGAINST | oABSTAIN | |||||

| |||||||||

3. | IN THEIR DISCRETION ON ANY OTHER MATTERS THAT MAY PROPERLY COME BEFORE THE MEETING. | ||||||||

(CONTINUED ON REVERSE SIDE)